Thanks !

You can pay your premium as monthly instalments or a single annual payment.

$ p/m

($ Total)

Pay your premium

over 12 monthly instalments

$

+ one time setup fee $

Pay annually and save

$ Total

The total includes GST

and government charges

What’s next? You’ll need to provide some documents and photos of your jewellery items

Want to read over the fine print? Check out our PDS here.

Have some questions? We would love to hear from you.

Thank You!

Your application has now

been submitted

Our team will be in contact with you

shortly via phone or email with the

next steps

Have some questions? We would love to hear from you.

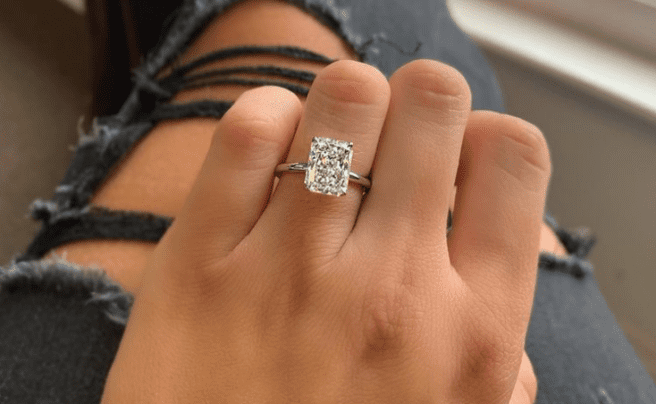

If you own an expensive or piece of jewellery or one with sentimental value, such as an engagement ring or a special watch, it’s important to insure it in case of damage, loss or theft.

If you own an expensive or piece of jewellery or one with sentimental value, such as an engagement ring or a special watch, it’s important to insure it in case of damage, loss or theft.

Jewellery insurance will give you the peace of mind that, should you be unlucky enough to have your precious item stolen, or it’s damaged or destroyed in an unexpected event such as a fire, the financial side of your loss will be covered.

Here we take a look at what jewellery insurance is and how to find the best policy for you.

Jewellery insurance is cover to financially protect your valuable items such as rings, necklaces, watches and earrings, should they be stolen, destroyed or damaged. In the event of a claim, your insurer will usually replace or repair your jewellery, or offer a cash settlement or voucher.

If you have home & contents insurance, it should cover your personal belongings if they are damaged, stolen or destroyed in your home. A comprehensive policy is likely to include some cover for jewellery but it usually will include reference to what is termed a ‘single-item limit’, which is the maximum amount you’ll be able to claim for one item.

The amount of cover for each item will vary according to the policy generally between $1,000, $1,500 or $3,500. In the event of a claim, this is the maximum sum you’ll receive for any single item you own item, no matter its value – meaning you may lose out financially.

If you have several items of value, there may be an additional aggregate limit on how much you can claim in total.

Note that this single-item limit applies to any possession, not just jewellery. You, therefore, need to consider your options if you have high-end home entertainment equipment, antiques or collections.

If you have items of jewellery worth more than the single-item limit amount on your policy, you’ll need to talk to your insurer about adding extra cover for them as ‘specified’ or ‘listed’ items or ‘valuables’, which is likely to increase the cost of your policy.

If you have a piece of jewellery of very high value – say, $10,000 or more – your insurer may decline to cover it under a standard policy (again, the figure will differ from insurer to insurer).

If insuring certain items of jewellery under your current contents insurance isn’t an option, or you’d like a more tailored policy, some companies offer standalone jewellery insurance.

Standard home contents insurance policies may not provide cover for jewellery that is stolen or damaged if you take it away from home, so check your policy carefully. Additional cover for while your belongings are outside the home is known as ‘all-risks’ or ‘personal possessions cover and may be offered as an add-on to your existing policy.

The items insured will differ between policies, but rings (including wedding and engagement rings), watches, bracelets, necklaces and earrings are typically covered by jewellery insurance.

To ensure you’re adequately covered in the event that you need to make a claim, you should save receipts for new pieces of jewellery and get a valuation on older pieces from an expert such as a dealer or a jeweller. When you come to make a claim, you may need your receipt or valuation certificate.

To ensure you’re adequately covered in the event that you need to make a claim, you should save receipts for new pieces of jewellery and get a valuation on older pieces from an expert such as a dealer or a jeweller. When you come to make a claim, you may need your receipt or valuation certificate.

It’s wise to get your jewellery revalued regularly too as the price gold and other precious metals can fluctuate.

Crucially, if you are given or buy new high-value jewellery part way through a policy, phone up your insurer to add it as a specified item so it’s covered from the day you bring it home.

It may also be worth taking photographs of your jewellery to help with a claim. Be sure to capture any unusual or distinguishing features, including any hallmark, and to make a note of the manufacturer’s name or any other details.

The cost of your contents insurance overall will be determined by a number of factors including where you live, your claims history and the security measures you have in your home.

It will also take into account the high-value and higher risk items you add on to your insurance, such as your jewellery, with the more high-value items you add generally meaning the higher your premium.

Making sure that you accurately know the cost of your jewellery will help you to avoid paying too much as, if you overestimate its value, you may end up paying more than you need to. On the other hand, if you underestimate it, you might lose out financially in the event of a claim.

When renewing your home contents insurance or buying a standalone jewellery insurance policy, it’s important to shop around to find the most suitable policy for you at the best price.

If you buy your contents insurance and buildings insurance from the same company, you may get a discount – but make sure this actually saves you money by comparing policies from different companies too.

Having certain security measures in place, such as a burglar alarm or high-quality locks may also reduce your premium, as well as helping you to feel more secure, so talk to your insurer about this.

If you have items of very high value, your insurer may require you to keep them in a safe. In some cases, you may need to lodge the item with a bank for additional security, although this would be rare.

Home insurance and jewellery insurance come with an excess – this is how much you agree to pay towards the cost of any claim, and is deducted from any successful claim you make. Generally, the higher the excess, the lower the premium.

It could be tempting to agree to a higher excess to keep the cost of the policy down. However, make sure you could afford to pay this as, if not, your decision could work out to be a false economy.

To avoid any nasty surprises should you need to make a claim, you should read the terms and conditions of your jewellery or contents insurance policy carefully.

To avoid any nasty surprises should you need to make a claim, you should read the terms and conditions of your jewellery or contents insurance policy carefully.

Some items to think about include:

For an instant quote with Centrestone Jewellery Insurance click here

Or read the following articles: