Maybe your grandmother passes down an heirloom ruby necklace valued at $40,000 into your holiday stocking. Or perhaps you’ll ring in the New Year with a $15,000 engagement ring on your finger.

While you think these pieces are safe if they’re stashed in a jewellery box, what happens if you lose the necklace in a house fire or the ring is stolen from your bedroom? Will your homeowner’s insurance cover these pieces?

A standard homeowners insurance policy typically falls short of fully covering high-value jewellery. But you can add the right coverage if you know what to look for.

Let’s look at the three main methods for locking in jewellery insurance.

1. Basic Homeowners Insurance for Jewellery

A standard homeowners insurance policy covers jewellery, including losses caused by fire, a tornado, theft or vandalism. But the policy normally imposes a $3,500 limit for the theft of jewellery and watches, as well as precious and semiprecious stones. Why is the theft limit so low? Because jewellery is so easy to steal.

You can raise the home insurance coverage limits for jewellery, but even those dollar amounts might be insufficient. For instance, you might pay extra to bump up the limits to $5,000 per piece and $10,000 overall—which may still not be enough.

Too many homeowners discover when it’s too late that their standard home insurance won’t fully cover the loss of a $25,000 ring, says Lachlan Renshaw, founder of Centrestone Jewellery Insurance, an insurer that covers jewellery. “That’s a difficult pill to swallow,” he says.

If you make a home insurance claim for theft or damage, such as fire damage, your insurance check will be reduced by the amount of your deductible.

2. Insurance Floater for Jewellery

You can get better jewellery insurance by supplementing your homeowner’s coverage with what’s known as a “personal articles floater,” which costs more than simply raising the coverage limits on your homeowner’s policy.

A floater can cover jewellery that exceeds the coverage limits of your homeowner’s policy. A floater itemises each piece (such as that ruby necklace or engagement ring) and lists types of losses that might be excluded, such as jewellery destroyed in a flood.

A deductible typically isn’t applied to a floater.

A floater provides jewellery insurance that’s broader than a standard homeowners policy. For instance, a floater covers an “accidental loss”—like dropping your engagement ring down the bathroom sink or leaving a necklace in a hotel room. When you buy a floater, you’re required to get each itemised piece professionally appraised.

Floaters usually cover items no matter where they are, such as in your home, on a plane heading to France or in a hotel room in the Caribbean.

3. Specialised Stand-alone Policy for Jewellery

A stand-alone jewellery insurance policy can be purchased from a company that specialises in insuring jewellery.

Many stand-alone policies and floaters offer similar components, although this varies from insurer to insurer. The similarities may include:

- Coverage for a variety of problems, such as theft, accidental loss and mysterious disappearance

- Coverage of the loss of part of a set, such as one diamond earring

- Coverage for jewellery that you take with you on international trips

However, a specialised jewellery policy may go beyond a floater by covering incidents that a traditional insurance policy might not cover, such as a chipped stone in a ring or a broken clasp on a necklace, according to Lachlan Renshaw.

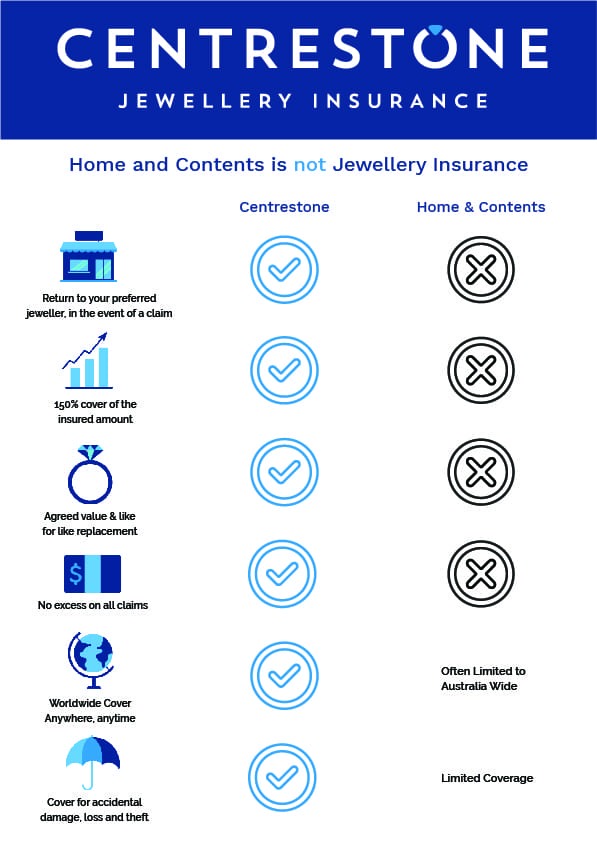

In many cases, annual coverage from a speciality insurer costs 1% to 2% of the jewellery’s value. Centrestone Jewellery Insurance says this means a $15,000 engagement ring could be covered for $423.50 a year, with no excess fee in the event of a claim and up to 150% cover.

For extremely valuable jewellery, Centrestone Jewellery Insurance 150% cover is an important feature, as it ensures that the item can be replaced to the value up to 150% of the item insured. This is also why Centrestone Jewellery Insurance offers a free annual valuation on your jewellery items.

One advantage to a separate jewellery insurance policy is that claims stay off your home insurance record and therefore won’t affect your future home insurance rates. Centrestone Jewellery Insurance also lets you choose the jeweller that repairs or replaces your lost or damaged item. (Other insurers may work with their own services to settle a claim, meaning a policyholder might not be able to rely on their own jeweller to repair or replace an item, says Lachlan Renshaw)

“We have had a lot of success stories where we were able to save the day because the fiance lost the [engagement] ring he had coverage with Centrestone Jewellery Insurance and we were able to quickly work with his jeweller to get an identical replacement,” Mr Renshaw says.

Centrestone Jewellery Insurance offers insurance for jewellery and watches that provides replacement cost coverage for 150% of the item’s appraised value and no excess fees in the event of a claim.

Tips for Protecting Your Jewellery

- Keep copies of purchase receipts.

- Take pictures of your jewellery.

- Store valuable jewellery in a secure place, such as a safe deposit box. Lachlan Renshaw suggests stashing high-value jewellery in a heavy at-home safe that’s bolted to the floor and out of sight.

- It can also be a good idea to keep jewellery in different places in your home to make it harder for thieves to find and steal all of your pieces.

- When you’re travelling, bring only those pieces of jewellery that you plan to wear. Going a step further, Mr Renshaw recommends travelling only with costume jewellery, rather than with high-value items.